It’s a good thing that opening a bank account is becoming more and more easy for common people and those who have no regular employment. A bank account is very important because it is one of the safest place where you can save money and at the same time earns interest from the money you have placed in the account.

In this article, I would like to give information about BPI Globe Banko, a revolutionary way of banking in the Philippines. It opens the banking industry for poor and common people who have no access for high maintaining balance in most of the existing banks today.

What is BPI Globe Banko?

My first recall about BPI Globe Banko was during my vacation in the Philippines several years ago while watching Eat Bulaga. During the program, Bossing Vic Sotto is giving money through BPI Globe Banko as a savings account to the winning contestant of Juan for All, All for Juan.

Though I’m not promoting game shows and other TV programs, in some ways, some people were given help through this kind of program. Good thing, they also help people to learn how to save and use their money in more productive ways.

BPI Globe Banko is the first mobile-based banking service in the Philippines and perhaps in the world. It was established in 2009 with the partnerships of BPI bank, Globe Telecom and Ayala Corporation.

This type of bank account functions like a micro savings account because you only need a very small amount of money to open an account compared with other regular bank accounts.

How to Open a BPI Globe Banko Account

In order to open a Banko account, you should visit any Banko Partner outlet like Generika, Tambunting Pawnshop, Prime Asia Pawn & Jewelry Shop, Inc., CVM Pawnshop and Money Changer, and MCPI. Bring the following requirements when going to this partner outlet if you want to apply for an account such as:

1. Globe or TM SIM card (with your mobile phone of course)

2. P100 (P50 for the ATM card and P50 for the initial deposit)

3. Photocopy of 1 valid ID or if you have no ID, a barangay certificate with photo can be accepted

Transaction Fees You Need to Pay

For every transaction that you make using your Banko account, you need to pay a transaction fee to do so. Below you can see the fees for a range of money to be withdrawn or deposited in your account.

Features of BPI Globe Banko Account

BPI Globe Banko account has almost the same features and functionality like a regular account of most banks in the country. However, this bank account is mobile phone-based, meaning, you need to have a mobile phone to be able to make transactions such as when opening an account or applying for loans.

In addition, you can only use Globe or Touch Mobile phones when opening an account since it is partnered with Globe Telecom. Therefore, Smart, Talk and Text and Sun mobile phone users need to change their telecom.

Below you can find the valuable benefits you can get from BPI Globe Banko.

1. Micro Saving

If you don’t have a big amount of money for opening a bank account and the maintaining balance you should keep, this kind of bank account is definitely for you. For as low as P100, you can open an account and deposit minimum of P50 per single transaction.Additional benefits are provided to depositors who save more.

The interest rate per year that you can earn from Banko account is 3% per annum. You may also choose the 1% interest per annum plus free life insurance coverage up to 5 times the amount of average daily balance of your account. The maximum insurance coverage is up to P200,000.

2. Micro insurance

This feature can be availed by any Banko account holder as an insurance for accidental death and damage to properties. The insurance premium is only P365 per year with the following benefits that you can get:

- P2,500 assistance in case of flood, typhoon and earthquake, or P5,000 in case of fire and lightning (to home or place of business)

- P50,000 benefit to beneficiaries in case of accidental death of the insured person

How do you apply for this micro insurance? First, you should dial *118*1# and press call on your mobile phone to access the Banko menu. After that,type 4 for Payments. Then,type 2 to Buy Insurance. Finally, just follow the procedures as directed.

3. Pay Bills

You can use Banko account to pay bills like Meralco, Manila Water, Maynilad and many more through your mobile phone. In order to pay bills, just follow the steps below:

- Dial *118*1# and press Call on your mobile phone to access the BanKO menu

- Type 4 for Payments

- Type 1 for Pay Bills

- Type Bill Amount

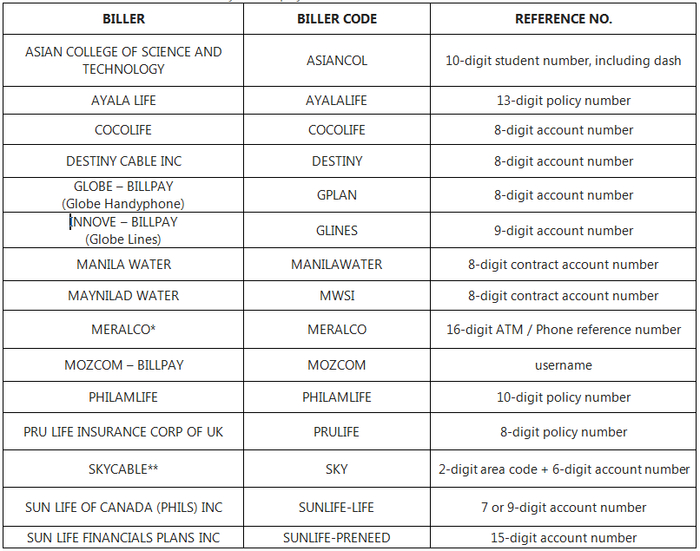

- Type Biller Code

- Type Reference Number

- Type MPIN

As a reminder for Meralco bills: you need to make payments in the exact amount and it should not be overdue. For SKYCABLE, only non-Metro Manila subscribers can pay through Bank.

4. Buy Load

If you find it difficult to buy your prepaid load, then owning a Banko account can be a great help because you can buy load using your mobile phone. A great bonus will be the 10% discount that you can get each time you buy the load.

In order to purchase prepaid load using your cell phone, here’s the steps:

- Dial *118*1# and press Call on your cellphone to access the BanKO menu

- Type number 4 for Payments

- Type number 1 for Buy Load

- Type the amount you want to buy (you can only buy load from 10 to P150 or P300 or P500)

- Type 11-digit Globe/Touch Mobile number

- Type MPIN

Concluding Thoughts

I congratulate BPI, Globe and Ayala Corporation for starting this kin of bank because it will greatly help common people to start saving their money in better and easier way. Since regular bank accounts have high initial deposit and maintaining balance, opening a BPI Globe Banko account can be done easily for as low as P100 at the initial opening.

I don’t have a Banko account as of this writing but will definitely open one in the future. I hope partner outlet will be more accessible. If you don’t have a big amount of money but you want to have savings account, you should try this one.

I’m not sure whether you can use this bank account for remittance. Maybe you can ask the in-charge person when you open an account to confirm your query.

Disclaimer: I’m not in anyway connected or affiliated with BPI Globe Banko. This post is for informational purposes only for all the readers and visitors of this blog. Thanks!

Reference/ Image Credit: Banko

Comments on this entry are closed.

Hi! Naiinis na po ako sa BPI BOSSING SAVINGS NA toh.. bakit ganun?? Tumawag ako sa Toll free number ng Bangko na may hawak sa bossing savings.. hanggang ngaun wala pading update about dun sa remittance na pinadala ng sis ko last september 7 pa.. nakakainis na po talaga… hindi ko alam kong ngbobogus ba tong hotline na to or wat..

Please help me.. :'(

how can apply online and have saving account without valid i.d and barangay certeficate

paanu po ba mag bukas ng count kht walang valid id at barangay certeficate

Hi, you cannot apply without valid ID. You should have at least school ID, postal or voter’s ID..

how can apply online and have saving account

Is this valid until today .? I want to apply ..

Great info; thanks for sharing.

It’s a great savings tool, specially because of the 3% per annum interest. That’s practically time-deposit level interest already.

I’m not crazy about the fees when cashing in and out. It doesn’t seem advisable for transacting business. But the 10% discount on the load is a great deal.

Hi, yes you’re right, BPI GLobe Banko is really a great deal. I will open this type of savings account soon.